Do you know which ICP helps you achieve Product-Market Fit, the fastest?

Because ICP evolves along the PMF journey.

This is a rich insight most founders intuitively sense but rarely articulate. As a founder you need a lens to not just find PMF, but to understand who it’s for at each stage.

Your ICP isn’t static. Most startup frameworks focus on finding product-market fit. Few explain how your ICP evolves as your product takes shape. PMF isn’t just a product problem — it’s a customer clarity problem. In this article, we’ll explore how your Ideal Customer Profile shifts across PMF stages, using the 9-question value logic and real-world signal frameworks.

By connecting the value logic questions, the PMF frameworks, and the ICP evolution, you will gain a lens to not just find PMF, but to understand who it’s for at each stage.

PMF is not Binary. It’s a Spectrum

Most startup content treats PMF as something you “achieve,” like a funding milestone. But in reality, it’s a gradient.

Frameworks like Lenny Rachitsky’s three circles—Desirability, Viability, and Usability—help visualize the components of PMF. First Round’s 4-level model brings nuance by showing PMF as a progression, not a binary. Rob Snyder’s 5-level framework and Jeroen Coelen’s PMF Scale go even further, helping you diagnose the current strength of your fit.

But here’s what most frameworks miss: as your product evolves toward fit, your Ideal Customer Profile (ICP) evolves too. Your earliest ICP isn’t your forever ICP. The customer who gives you your first “yes” may not be the one who takes you to scale.

Which brings us to the next insight.

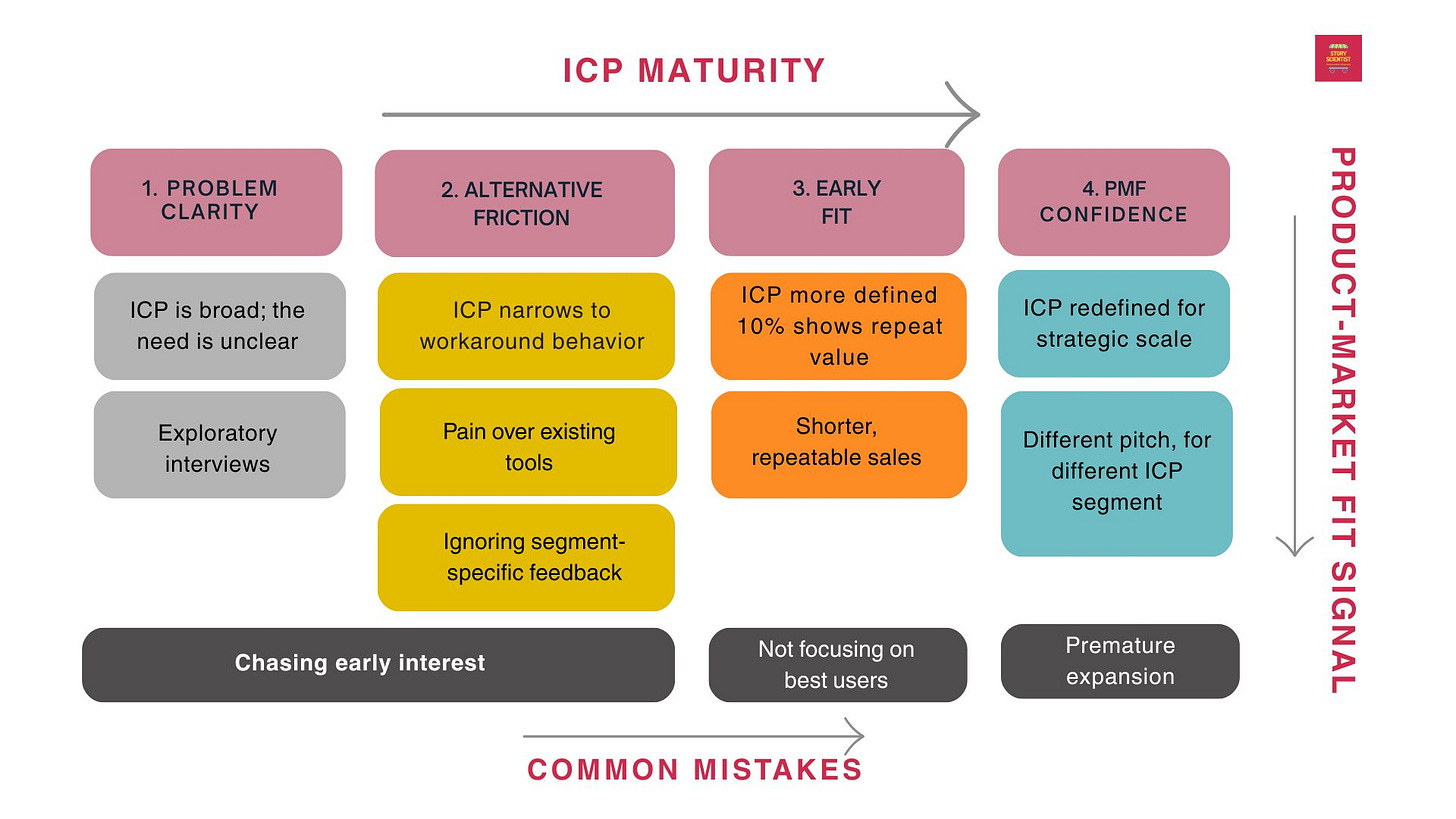

The 4 Stages of ICP Evolution Along the PMF Journey

Let’s walk through the four stages where your ICP matures alongside your product, mapped against both signals and founder pitfalls.

Stage 1: “Who’s in Pain?” (Problem Clarity)

ICP Characteristics: Very broad. Often described in terms like “SMEs” or “anyone with X need.”

Your Role: You’re exploring. You’re talking to people. You’re not sure who needs you most yet.

Value Logic Questions to Use:

Who is your beachhead segment?

What job are they trying to get done?

What’s stopping them?

Signals to Look For:

Insights from exploratory interviews

Clarity around Jobs-to-be-Done

Repeat mentions of a shared frustration

Common Mistake:

Chasing early interest from too many directions, diluting your narrative and wasting GTM resources.

Stage 2: “Who’s Trying to Solve This Already?” (Alternative Friction)

ICP Characteristics: Starts to narrow based on workaround behaviors—people actively trying to patch the problem.

Your Role: Understand their dissatisfaction with existing options. This is about why they haven’t solved the problem yet.

Value Logic Questions to Use:

What are the dominant alternatives?

What’s broken about them?

What are the consequences of using them?

Signals to Look For:

Frustrations with current tools

DIY workarounds

Clear consequences of inaction

Common Mistake:

Making the message too generic. Overlooking segment-specific frustrations in favor of mass-market appeal.

Stage 3: “Who Gets the Most Value, Fastest?” (Early Fit)

ICP Characteristics: Now you start seeing a value-dense subsegment—the 10% that closes faster, retains longer, refers more.

Your Role: Double down. Tailor everything—your sales narrative, onboarding, case studies—to this group.

Value Logic Questions to Use:

What’s your one-line pitch?

How does it fix the problem?

Signals to Look For:

Shorter sales cycles

Consistent messaging working across calls

Warm referrals from a specific customer type

Common Mistake:

Not recognizing the pattern. Still building for too many edge cases or holding onto past ICPs emotionally.

Stage 4: “Who’s Worth Scaling For?” (PMF Confidence)

ICP Characteristics: Your ICP is redefined for strategic scale. You have conviction. You speak in specifics.

Your Role: Build systems, marketing assets, and pricing around this clear ICP. You’re no longer hunting—you’re shaping.

Value Logic Question to Use:

How does your solution outperform the known alternatives and solve known shortcomings?

Signals to Look For:

Same pitch closes repeatedly

Case studies from this ICP land hard

You're referred directly to “others just like us”

Common Mistake:

Premature expansion into adjacent segments without strong signal consolidation from your core.

Your Messaging, Channels, and Features Must Match the ICP Stage

Not only does your customer evolve, but their information habits evolve too.

Early-stage ICPs (Stage 1–2) might be lurking on Reddit, consuming blog posts, or talking in founder groups.

Mid-fit ICPs (Stage 3) are checking your G2, trying your product, or asking for integrations.

PMF-ready ICPs (Stage 4) are ready to swipe the card or introduce you at scale.

Misalign these, and even the best product gets ignored. Some Don’ts that you would pay attention to are:

Don’t run Product Hunt launches when your ICP is still trying to articulate their problem.

Don’t send cold outbound if your ICP only buys through community trust.

Don’t laze out on running Discovery calls before you work on cold calls.

Why most Founders miss this?

They confuse early users with repeatable customers

They don’t track feedback or behavior by segment

They assume PMF is about product refinement, not segment-messaging-solution resonance

You may be one ICP decision away from a working GTM.

What to Do Instead: Layer in the Value Logic Questions as a Diagnostic

Jeroen Coelen’s Value Logic framework provides a clear way to assess whether your product, messaging, and ICP are aligned at each stage of your growth. It acts like a mirror showing where you’ve jumped ahead too fast or ignored important feedback.

Offer this to your audience or clients as:

A self-assessment tool

A founder reflection journal

A 30-minute diagnostic exercise before any pivot

Here’s a recap of how the ICP evolves as your PMF strengthens:

What to Do Instead: Layer in the 9 Value Logic Questions as a Diagnostic

The Value Logic framework created by Jeroen Coelen draws from proven principles in Jobs-to-be-Done, customer research, and positioning strategy. These nine questions form a structured conversation that helps founders validate not just their product idea, but the evolution of your Ideal Customer Profile along the Product-Market Fit journey.

Think of these questions as your compass. They don’t just confirm if you’re heading toward PMF they reveal who you’re building for at each step, and whether that segment is maturing with you.

How to interpret this table for your business?

If you struggle with Questions 1–3, your ICP is underdefined, and you’re likely pre-PMF.

If your answers to 4–6 are unclear or hypothetical, you’re still in segment exploration and not yet in Early Fit.

Strong, tested answers to 7–9 suggest you're entering repeatable GTM territory and can begin to systematize growth.

This framework doesn’t just tell you if you have PMF, it also tells you what type of PMF you’re building, with whom, and whether it’s ready to scale.

Clarity Compounds, But Only if You Track the Right Customer

PMF isn’t a feature checklist. It’s a mirror that shows you whether the right kind of customer keeps coming back faster, happier, and louder than the last.

Don’t just iterate on product.

Iterate on who it’s for.

That’s where real traction lives.

Ouch..I have been guilty of confusing early adopters with scalable ICPs!!

This is a master piece